Crude's decline to five-year lows is clearly not a good thing for the energy sector, which is down nearly 13 percent this year. But one sector's loss in this case is another's gain, and many stand to gain from American consumers having more money in their pockets, especially during the holiday shopping season.

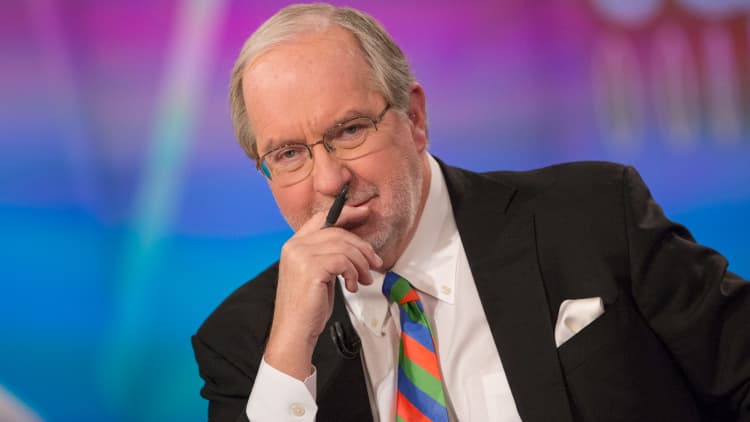

"As energy and materials are dropping, the other 80 percent of the S&P 500 benefit, but if it drops too far, it could develop into a scenario where the job creation and high-paying jobs in the energy patch shut down. But in the near term, consumers are getting a break here. It's a big tax cut for most people," said Bruce Bittles, chief investment strategist for RW Baird & Co.

"The only thing we're going to talk about this week and for the rest of this year is the price of a barrel of oil and how low it can go. AAA is talking about the national average of gasoline hitting $2.50 a gallon before the end of the year, that's a dollar less than it was a year ago," said Art Hogan, chief market strategist at Wunderlich Securities.

Brent crude and West Texas Intermediate both slid to lows not seen since 2009 on Monday, continuing a trend that had both dropping 18 percent in November as the Organization of Petroleum Exporting Countries opted to keep its 30 million-barrel-a-day production objective.

Read More Oil and the banks: As prices fall, risks may rise

OPEC's decision to not curb output, increased U.S. production and indications of softening global demand are all factors in pushing the price of crude to levels not seen since July 2009.

"Part of the drastic drop in energy prices has to do with supply, we've gotten too good at finding it. And there has been a bit of a pullback in demand, largely due to a slowdown in Europe and China," said Hogan.

"We could be creating a very volatile environment for oil over the next couple of years. If it trades below $60 (a barrel) for months, I would think that would be problematic," Bittles said.

"The next level that is important is wherever this stops," Hogan said.